Our teams

As a law student, we know it can be confusing to understand the different teams and practice groups that make up a corporate law firm, let alone know which teams you’re interested in trying out! Although no two days are the same and work can vary across each office, we thought it would be helpful to give you first-hand insight into what life is like for lawyers in each team.

Read more about what it is like to work in each of our teams

Corporate & commercial

Litigation & dispute resolution

Finance

Financial services regulation

Private client

Property & real estate

Tax

Environment, planning & resource management

Competition & regulatory

Construction & major projects

Te Waka Ture

Corporate & commercial

We help large companies with any legal issues relating to the day-to-day operations of their business, or if they need legal advice on large-scale transactions. We work in “sub-teams”: mergers and acquisitions, equity capital markets, and general corporate advisory. Our clients include New Zealand’s largest corporates, often listed companies, such as Vector, Mercury, EBOS, BNZ, Microsoft, Fonterra, and Precinct Properties. During large transactions we work a lot alongside other professional services such as accounting and investment banks.

What does a junior in corporate and commercial do?

You’ll work on a variety of different documents including drafting and reviewing sale and purchase agreements, IPO offer documents, takeover documents, board resolutions, or statutory compliance docs…to name a few. As a junior, we do a lot of due diligence (reviewing legal material) for the sale/purchase of different businesses.

Who do you work with?

On the advisory side, juniors deal directly with clients (and opposing lawyers) to negotiate business-as-usual contracts – which is awesome exposure! With some clients, we run drop-in clinics where juniors go out to their premises once a week to answer legal questions. In more transactional teams, you’ll be working with other team members (both in corporate and other teams like tax, property or resource management) and working closely with partners.

“Corporate is a large, broad practice that leaves you doing challenging and intellectually stimulating work every single day. From drafting and varying agreements to being part of a massive merger or listing a company on the stock exchange, no two days are ever the same. You are constantly learning and developing a wealth of knowledge to assist our clients in achieving their goals.”

Litigation & dispute resolution

Chapman Tripp’s litigation & dispute resolution team acts on New Zealand’s most significant commercial disputes. The team solves our clients’ problems and disputes, in differing ways: through negotiations, mediations, arbitrations or through the Courts, working with our clients to secure a resolution that works best for them. We deal with large-scale disputes in our team and harness technology to streamline litigation processes.

What does a junior in litigation do?

The work is varied – some days you’ll be drafting court documents, such as affidavits or applications, and other days will see you preparing research summaries that will give you a greater understanding of a point of law. You will also be engaging in ‘discovery’ – which is reviewing client documents and looking for evidence for our case. Our clerks are regularly in contact with clients, barristers and other lawyers.

Who do you work with?

Juniors work with lawyers of all levels in the litigation team, including working directly with their supervising partner and collaborating with our senior legal staff to achieve our client’s objectives. Where trial advocacy has been outsourced, we may work with QCs or other external senior counsel.

“I am a solicitor in the litigation team, with a focus on restructuring and insolvency. Most of my work involves preparing court documents, including court applications, legal submissions and affidavits. I also do a lot of legal research to help my team understand novel points of law. I am in regular contact with clients, keeping them up to date on the work we are doing for them. I have been involved in heaps of really exciting cases, getting to work on a number of court trials and hearings. It is always thrilling to have your work get in front of a judge. More recently, I have even had the opportunity to appear in court myself!”

Finance

All of our clients have funding requirements and this is where the finance team comes into play. The team works in debt capital markets in New Zealand and overseas, project financing including some major crown infrastructure projects, corporate lending and borrowing, consumer lending, and restructuring and insolvency.

What does a junior in finance do?

There is scope to get involved across all areas of the team – whether it’s debt capital markets, corporate lending or restructuring and insolvency. You’ll work on corporate authorisations (resolutions needed for companies to enter transactions), PPSR searches and drafting legal opinions as well as a variety of other legal drafting specific to the transaction. You also get to communicate directly with the client including working closely with most major banks in New Zealand, the Treasury and a variety of corporates and market leading issuers of financial products.

Who do you work with?

You’ll deal directly with clients quite a bit at a junior level in the finance team. The partners place a large amount of trust in you to manage aspects of a transaction and take responsibility for it, while still being available for the inevitable questions you will have. The finance team also works with other firms both in New Zealand and overseas on a regular basis – some knowledge of time zones can come in handy!

“The Finance team is a great place to learn fundamental legal skills. I have been exposed to a range of different transactions from corporate refinances to government grants. The team intersects and works with many of the other teams in the office so you will develop the basics of drafting and reviewing contracts across many contexts.”

Financial services regulation

The financial services sector is highly regulated, constantly changing and vital to our economy. Our team is essentially a commercial team, with a particular focus on the financial services sector. We work with banks, insurers, and organisations which manage and invest money (such as KiwiSaver providers and international fund managers). We help them to develop investment products, and set up, run and buy and sell their businesses. Our team make submissions to legal consultations and engage with officials, to ensure law makers are aware of how the proposed laws may appear to work in practice. Thus not only do we provide advice to clients on the law and how it may affect their business, our team has also played a leading role in shaping New Zealand’s new financial advice regime and regulatory frameworks.

We advise on the establishment and compliance of various investment products and structures. We also help clients satisfy the financial markets regulatory regime, make applications to and negotiate with regulators like the Financial Markets Authority and Reserve Bank, advise on anti-money laundering compliance, help insurers with their prudential supervision, and assist with the sale and purchase of funds management and insurance businesses.

New Zealand’s financial services law and regulatory regime has recently undergone legislative changes, while other reforms are still underway. Reforms mean the rules change quite often – our clients look to us to make sure they remain compliant and that any changes to the law are made workable in practice. Technology and innovation are also having a big influence in the financial services sector, and we are at the forefront of these changes.

What does a junior in financial services do?

You’ll help draft letters of advice, legal opinions and memos on how the law applies to a client’s circumstances, as well as legal research, and prepare documents to establish new financial products. You will be deeply involved in advising clients with a range of compliance and regulatory matters, so there is never a dull day!

Who do you work with?

We are a small, tightly knit team and work very closely together. We can also be found interacting with legal counsel, fund managers, heads of investment divisions and regulators, as well as working with CT’s corporate, tax and finance teams on aspects of transactions or other advice.

“Much of our work is at the forefront of legislative reforms and we are often engaged to provide advice to clients who are trying to navigate their way through this highly regulated industry. Coming from a banking background, I am genuinely interested in the reforms affecting our financial services sector, and how we are able to help clients with our legal knowledge.”

Private client

The private client team advises high net worth individuals and families. Most of our work is related to trusts but we also advise more generally on inter-generation asset planning (including relationship property issues) and a wide variety of other work that our clients need help with. This extends into corporate and property-related work in respect of our clients’ interests and we work closely with our colleagues in the corporate, property, resource management and tax teams. We also work with a number of charitable trusts and incorporated societies, a good portion of which is pro-bono. We commonly review and update the trust deeds or rules of existing charities. We also establish new charities which involves drafting new trust deeds or rules and assisting with applying to the Department of Internal Affairs to become a registered charity.

What does a junior in private client do?

As a junior, you will draft trust documents, for example to establish a trust, vary the terms of a trust, appoint or replace a trustee or resettle the assets of a trust onto a new trust. Preparing wills, enduring powers of attorney and letters of wishes are also day-to-day tasks you will be working on. You will also be asked to research issues of law (often in respect of trusts and other equitable principles but including issues as wide ranging as relationship property questions, mental capacity issues and questions related to wills and estates), and prepare drafts of advice to clients. These are developing areas of the law at present, both in terms of legislative reform and case law, and this is a challenging and interesting field.

Who do you work with?

You can expect to have lots of direct contact with clients week to week. For some significant clients you may be contacting their staff that work at their Family Office, and are often liaising with clients’ accountants and tax advisors.

We work a lot with the property team, tax team and sometimes the litigation team. For example, if our clients are wanting to sell our purchase property, whether that be individually or through their trust, we may need the property teams assistance. The tax team provide us with advice when we are working with trusts to make sure we are meeting compliance obligations. The litigation team is sometimes necessary if cases progress beyond what our team can manage and are to be heard in court.

“The Private Client Team offers a wide range of work from trusts, wills and relationship property agreements to working with charities and not-for profit organisation . It’s an area that I find relevant to everyday people and is forever evolving to keep up with the times.”

Property & real estate

The property team produce legal work that gets buildings developed, built, tenanted and sold! We advise clients on how to best approach property management, development and construction from a legal perspective. The property market is always one to watch. Bank lending and interest rates influence development projects, and demand for commercial space influences leasing/transactional deals. Increasingly, we are seeing environmental and sustainability matters influencing the sector too.

The property team produces legal work for property developers, investors, contractors, large private and public corporates and private clients on an array of property-related matters. These clients have substantial commercial portfolios in the private and public sector. We provide advice on the full spectrum of property and real estate work, including acquisition and disposal, regulatory processes and Cabinet directives, leases and licences and, where necessary, dispute resolution. This work provides opportunities and crossover with other practice groups within Chapman Tripp including corporate, resource management, tax and litigation.

What does a junior in property do?

As a junior in the property team you’ll get to work on due diligence, drafting leases, sale and purchase agreements, documents relating to subdivisions, reports to the Overseas Investment Office, construction contracts, due diligence reports, mortgage documents, development agreements, legal opinions every now and then, records of title and associated interests registered on titles.

Who do you work with?

As part of the property team, you will interact with clients and other practices in the firm straight away. Internally, we do a lot of due diligence for the corporate team by reviewing all property-related documents where a company may be acquiring another company. We also work with the finance team to assist when lenders are using property as security for lending money and we also work with the resource management team. As a junior you’ll work closely with your partner, and interact with some clients directly – for example, on leasing & conveyancing matters.

“I enjoy the variety and pace of work in the Property team - no two days are the same. I've been involved in settlements, due diligence, drafting and OIO applications. It's exciting being involved in huge corporate deals and projects. But the people really make it. Everyone is incredibly friendly and supportive.”

Tax

Tax at Chapman Tripp involves working with big business clients who are leaders in their industries, both nationally and globally. As a result you get to work with international and domestic laws to provide structuring advice in novel areas, engage in some of the biggest disputes in New Zealand, and be involved in something different every day.

What does a junior in tax do?

The tax team tends to be a little smaller than some other teams at Chapman Tripp. This means you are often the only junior on a file working closely alongside seniors and partners, undertaking legal research, discussing your view of the law, coming up with solutions and drafting advice.

Who do you work with?

You work with your own team first and foremost. Depending on the day, you will also work with other practice areas in the firm, in-house lawyers, executives and representatives of the Inland Revenue Department.

“As a junior in the tax team a day at work might include researching and drafting advice for clients, working through cross-border issues arising in an upcoming transaction, working with other teams in the firm on the tax issues that have come up in their practice areas and communicating with Inland Revenue. The variety of the work has taught me the importance of being flexible in my thinking and approach.”

Environment, planning & resource management

The resource management team helps clients with areas of their business that interact with the environment. This includes assisting with consenting applications for major developments or infrastructure and helping clients with questions about environment-related matters. Our team often works with a wide range of experts and technical information, which makes the work fairly cross-disciplinary. Our team provides advisory services, and also dispute resolution services when needed.

What does a junior in environment, planning & resource management do?

We support clients to produce consent applications, which can include a series of technical reports. We also support expert witnesses to draft evidence for hearings.

As part of the team you’ll also help draft legal research memos on environmental matters – these can be incredibly interesting – prepare submissions for clients on consent applications, plan changes and new plans, prepare court documents where a matter goes to a hearing, and advise on new and upcoming legislation and policy.

Who do you work with?

Juniors generally work with others in the resource management team, but there are opportunities to meet and have calls with clients, including major New Zealand companies which all operate in different environments. We also work with other internal teams, including supporting the corporate and property teams for due diligence matters.

“At university, I was never certain on the type of law I wanted to practice. I was very happy to be offered a job in Chapman Tripp’s Christchurch environment, planning & resource management team and now I couldn’t imagine doing anything else. Even as a junior, I work directly under partners and I’m given a significant amount of freedom to run and manage my own files with direct client contact. The clients we work for are varied, which means the work we receive is never the same. I enjoy working on high profile projects that will contribute to Christchurch’s redevelopment and make it an even more amazing city to work, live in and visit. I am able to challenge myself every day and know I have an excellent support and supervisory network around me.”

Read more about out Environment, planning & resource management team

Competition & regulatory

The “comp and reg” team, unsurprisingly, focuses on competition and regulatory work, but also does work related to public sector governance and trade law.

On the competition side our work ranges from preparing clearance applications for mergers and acquisitions, to representing clients during Commerce Commission investigations.

In the regulatory area we interact with a number of government regulators such as the Commerce Commission and the Overseas Investment Office. We work with our clients to make submissions on changes to various regulations, and help them to ensure they comply with the regulations that apply to them.

What does a junior in competition and regulatory do?

You’ll work on a range of matters such as:

- helping to draft clearance applications to send to the Commerce Commission;

- helping to draft consent applications to send to the Overseas Investment Office;

- writing memos advising clients on aspects of their regulation;

- helping prepare responses to information requests, for example from the Commerce Commission and the Overseas Investment Office;

- preparing documents to file Commerce Act proceedings in court;

- drafting submissions to the Government on legislation they are creating;

- researching domestic compliance with international trade law; and

- assisting clients in the Pacific Islands on various matters, for example assisting new regulators.

Who do you work with?

Our team has a nearly equal partner to junior ratio, so you’ll work with the partners a lot, as well as other juniors and consultants in the team. You’ll also interact with regulators and contacting clients. We also work with our other corporate teams quite often, for example, to work out if a transaction will require Commerce Commission or Overseas Investment Office consent.

“I love working in the competition and regulatory team because it allows me to use a range of different skills in a number of different practice areas and to immerse myself in the businesses of the wide range of clients we work for. Having said this, the best part about the team is the people. After summer clerking in this team I knew I couldn’t miss the opportunity to work with such intelligent and fun individuals.”

Read more about our Competition and antitrust & Regulatory law teams

Construction & major projects

The Construction team works on a wide variety of work – from the beginning of a project phase, through to completion and beyond. We advise a range of clients on a large array of projects, both nationally and globally. We act for central and local government entities, private developers, contractors, consultants and project lenders. The projects we assist with range from residential through to large multi-million dollar developments.

What does a junior in construction & major projects do?

As a junior in the construction team, you’ll be exposed to a huge range of interesting work from the outset. Your work will include assisting with drafting and reviewing construction contracts, identifying potential risks facing our clients, assisting with due diligence, doing research and problem solving for disputes throughout the contract phase.

Who do you work with?

As part of the construction team you will work most closely with the wider property team on a day to day basis. You will also work with other teams across the firm on various matters, such as the finance team on larger contracts which involve project finance arrangements. As a junior, you’ll have a lot of interaction and support from your supervising partner along with the rest of the team. Our collaborative approach is a really efficient way to learn about best practice and get a grasp on the type of work that we do. You will also be given a lot of client interaction early on, with seniors in the team helping you build strong client relations by encouraging you to attend meetings and have regular communication with clients from the outset.

“The construction team acts for a diverse range of clients on many unique and differing projects. It offers varied and interesting work, meaning each day presents new and exciting challenges. Among other things, I have been involved in helping draft/review construction contracts/consultancy agreements; researching areas of law to assist with writing submissions for a dispute; and reviewing contractor tags as part of the negotiation process. I have also really enjoyed the team culture – we have a lot of fun and everyone is incredibly friendly and supportive.”

Read more about our Construction & major projects team

Te Waka Ture

E anga whakamua ana te waka (Forging a new path)

Te Waka Ture, our Māori Legal Group, specialises in providing commercial legal advice to iwi, hapū, Māori landowners, Māori businesses, and those looking to work with them, focusing specifically on:

- post-Treaty settlement transactions

- joint ventures, and

- collective iwi arrangements.

The Māori economy is growing rapidly as a result of the creation of large, asset-rich Māori corporates from Treaty of Waitangi settlements, and with the development of partnerships and joint ventures with Māori and non-Māori partners.

By drawing on our expertise and experience, our core team of iwi-focused lawyers can assist iwi and Māori organisations to maximise their commercial assets, helping them to achieve not only their commercial objectives, but providing a means to achieve their social and cultural objectives as well.

Te Waka Ture involves members from several different teams across our Auckland, Wellington and Christchurch offices. Being a member of Te Waka Ture allows you to be involved in several areas of work beyond your standard practice area, and deal with unique and interesting Māori legal issues. Some areas you might be involved in if you are a member of Te Waka Ture include Corporate, Resource Management, Property, Tax and Litigation.

“It’s exciting to be able to use your understanding of te ao Māori and your legal expertise to help ensure that clients get the best possible outcome.”

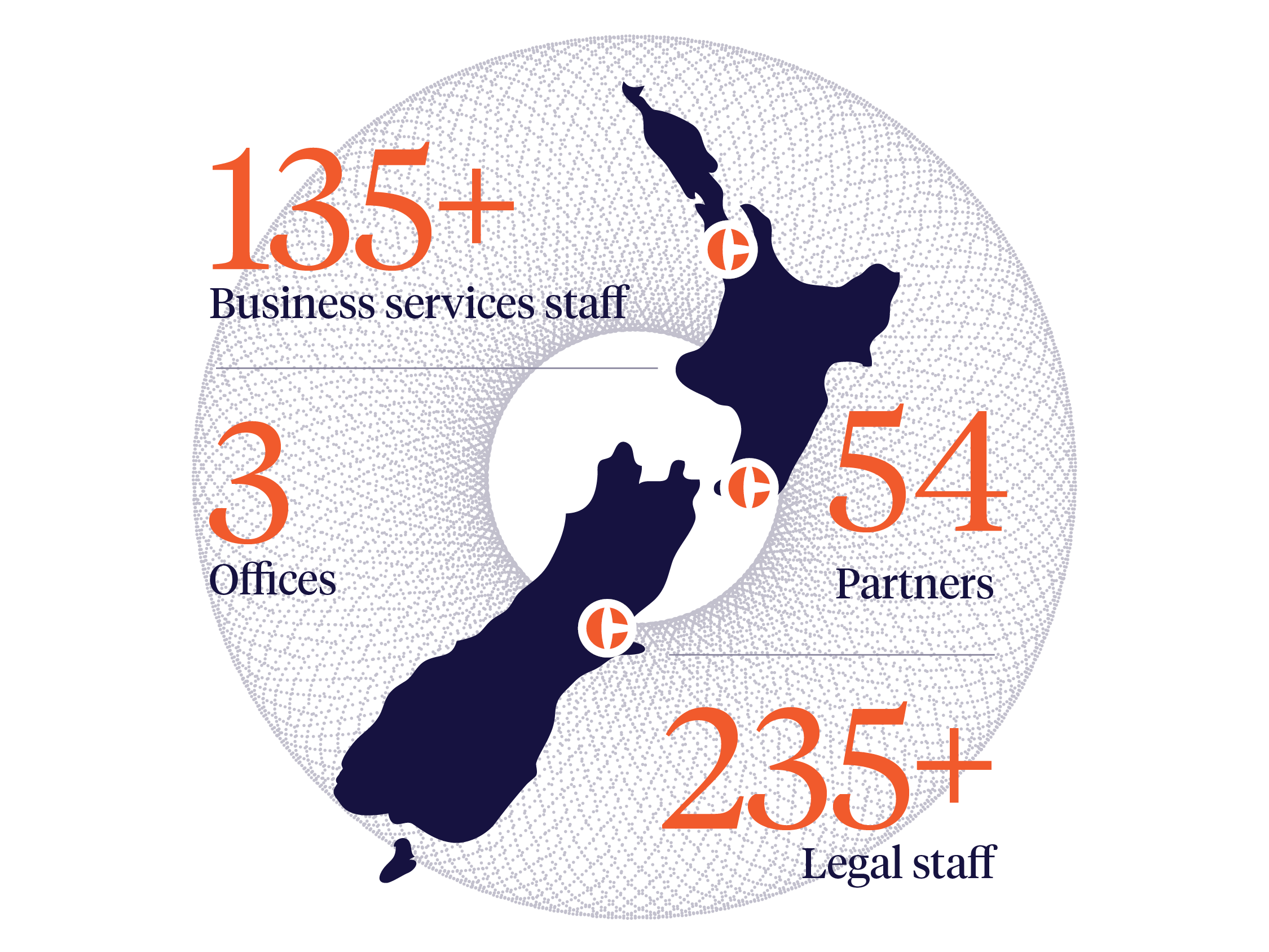

Auckland

- Construction & major projects

- Corporate & commercial

- Environment, planning & resource management

- Finance

- Financial services regulation

- Litigation & dispute resolution

- Private client & trusts

- Property & real estate

- Tax

- Te Waka Ture

Wellington

- Competition & regulatory

- Corporate & commercial

- Finance

- Litigation & dispute resolution

- Property & construction

- Tax

- Te Waka Ture

Christchurch

- Corporate & commercial

- Environment, planning & resource management

- Litigation & dispute resolution

- Property & real estate

- Te Waka Ture

We work on complex and challenging legal and commercial projects and advise major New Zealand and multinational organisations across the full spectrum of government, industry and commerce.

Our clients are shaping New Zealand and we love the thrill of immersing ourselves in their world to help them achieve their goals.

Our clients are diverse, working across different sectors and industries; and include major banks, financial institutions and investment funds, iwi, local and central government agencies and New Zealand’s most significant corporates.

Key clients including AMP, BNZ, Chorus, Mercury, Waka Kotahi NZ Transport Agency, Powerco, Transpower, Treasury and Vector choose to work with us because we’re known for providing clear, pragmatic and context-specific advice for use with a range of audiences and for diverse purposes.

We also represent the New Zealand interests of many international clients and have strong referral relationships with international law firms.

The experience exceeded my expectations and fuelled my passion to become a lawyer. It provided incredible insight into some of the ways I can pave a successful legal career, and each team made me feel comfortable included, and confident in my own intellectual abilities.

- Sam, Summer Clerk